Exuberance in the local tech sector is best reflected by the KLTEC index earlier in 2023, where it rallied to a short-lived c.10% and later deteriorated into a c.12% decline.

Following an uninspiring quarter four calendar year 2022 results during which the much-anticipated year-end demand boost failed to materialise, many players such as D&O Green Technologies (underperform; trading price: RM3.51), Malaysian Pacific Industries (underperform; trading price: RM20.00) and UNISEM (market perform; trading price: RM3.10) guided for an underwhelming first half of calendar year 2023 outlook as China’s reopening has yet to translate into meaningful recovery.

Not helping either is the high interest rates and inflation that led to downbeat order forecasts from customers. To prevent further margin erosion, Malaysian Pacific Industries has opted to delay the completion of its second plant in Suzhou by three months. Meanwhile, JHM Consolidation (market perform; trading price: RM0.80) also indicated that it will continue to put its Batu Kawan expansion on hold.

“However, it is not all doom and gloom as the electronic manufacturing services segment offers some opportunities,” said Kenanga Investment Bank Bhd (Kenanga) in the recent Sector Update Report.

Players such as PIE Industrial;(outperform; trading price: RM4.05) and Nationgate Holding (outperform; trading price: RM1.50) which are in the industrial products space have continued to benefit from growing demand.

PIE Industrial is expected to see an uptick in demand for its assembly of application specific integrated circuits equipment given the recent rebound in crypto currencies while Nationgate Holding has a robust pipeline of projects (for example, optical transceivers) transitioning from prototype into mass production which will contribute meaningfully in financial year 2023.

“We also see value in selected names that possess resilient earnings visibility such as Kelington Group (outperform; trading price: RM1.92) which is expected to thrive despite the temporary slowdown in the semiconductor space, buoyed by its RM1.7 billion order book as well as prospects from its tender book which recently ballooned to RM2 billion,” said Kenanga.

As such, Kenanga believes Kelington Group will remain an excellent proxy to the trend of wafer fabs expanding capacity for future recovery in chip demand and acts a safe harbour under this current challenging period. On the other hand, LGMS (outperform; trading price: RM1.50) will continue to gain from the growing demand for cyber resilience, in tandem with the expansion of the digital economy.

Due to the strict qualifications necessary, the barrier of entry in this industry is quite high. To further enhance its competitive advantage, the company is expanding into emerging digital economies like Cambodia and Vietnam, which are only just beginning to realise the importance of cybersecurity.

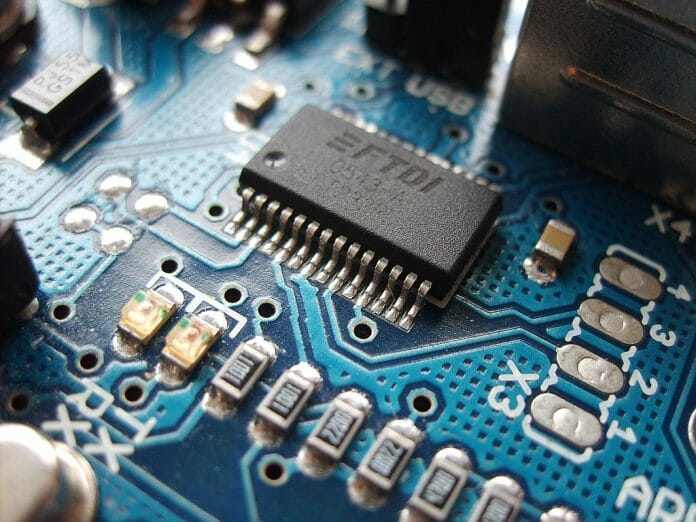

Amidst the growing tension between US and China spilling into the race for technological supremacy, OPPSTAR (under perform; trading price: RM1.30) — Malaysia’s first home-grown integrated circuit designer that debuted on the local bourse on 15 March 2023 — has been thrusted into the limelight as a beneficiary of Chinese integrated device manufacturer looking for alternative design solution due to restricted access to design software and fabrication equipment by the US.

The group’s business proposition has also been very well received by the investing community owing to its niche exposure to the front end semiconductor space which is higher up the value chain. However, its valuation has become rich after the recent run-up in share price, hence we downgrade our call from outperform to underperform with an unchanged trading price of RM1.30.

Overall, Kenanga maintains their neutral stance on the technology sector for the medium term as they expect softening of demand to continue into the first half of calendar year 2023. However, Kenanga is selectively positive on:

1. KGB for: (i) it being a direct proxy to the front-end wafer fab expansion, (ii) its robust earnings visibility underpinned by both robust order book of RM1.7 billion and tender book of RM2 billion, and (iii) its strong foothold in multiple markets, for example, Malaysia, Singapore and China.

2. LGMS for: (i) its unique exposure to the growing cyber security business, (ii) the deep moat around its business given the high barrier to entry created by the tough qualification process as a vendor, and (iii) its new proprietary certification software which is expected to be the next earnings driver.

3. PIE for: (i) its comprehensive skillset, making it a one of the top-choice electronic manufacturing service providers for multinational corporations, (ii) various competitive advantages it enjoys as a unit of Foxconn, and (iii) its diversified and evolving client base, from those involved in communication devices, power tools and the latest decentralised finance equipment.

Towards the global outlook, World Semiconductor Trade Statistics projects a contraction of 4.1% in 2023 as chip demand will continue to be dampened by weaker demand, particularly for consumer electronics, due to high interest rate and inflation.

This comes as 2022 global semiconductor sales growth of 3.3% fell short of World Semiconductor Trade Statistics’ estimate of 4.4% owing to significant slowdown in the second half of calendar year 2022.

Global chip demand has continued to contract since its first year-on-year decline in September 2022. Subsequently in December 2022, sales in the US turned negative for the first time with a 6.1% year-on-year decline, joining China and Asia Pacific markets in the negative growth trajectory.

Although the announcement of China reopening its borders in January 2023 lifted overall sentiment then, it had actually provided little boost to the underlying demand. This is evident by the muted demand in January 2023 (-18.5% year-on-year) as reported by the Semiconductor Industry Association (SIA) across US (-12.4%), Europe (+0.9%) and Japan (+0.7%), China (-31.6%) and Asia Pacific (-19.5%).

On smartphones, in the absence of a year-end shopping spree, the quarter four calendar year 2022 global device shipment declined 20% year-on-year.

The prospects are expected to remain cloudy owing to: (i) the smartphone market entering its seasonal low cycle in quarter one calendar year 2023, (ii) waning consumer interest to upgrade as the smart phone technology approaches the mature stage, and (iii) beginning of application service provider decline after a rapid increase in the last few years from $334 in 2019 to $415 in 2022.

Therefore, the International Data Corporation in early Mar 2023 had revised its 2023 global smartphone shipment forecast from a 2.8% growth to a contraction of 1.1%.

“We also maintain our neutral view on Inari Amertron (market perform; trading price: RM2.60) given its large exposure (c.60% of group revenue) to the smart phone radio frequency business,” said Kenanga.

While the group managed to sustain its revenue by delivering more legacy radio frequency models as a measure to cushion the underwhelming demand for the latest model, this was at the expense of margins. Meanwhile, its venture into new products as well as the ramp-up in its China’s operations will not be quick enough to cushion the immediate weakness.

Automotive demand in 2023 thus far has yet to show a pickup in numbers as consumers scale down on large-ticket item purchases amidst growing uncertainties surrounding the macro environment. China car sales on a year-on-year basis plunged – 32.9% in Jan (owing to the Chinese New Year holidays) followed by a 11.6% recovery in Feb while Europe car sales growth hovered around c.11% for both periods.

However, note that these numbers came from a low base comparison in the prior year due to the much worse semiconductor shortage in early 2022. While the long-term trend of electric vehicle adoption remains intact, the immediate outlook remains choppy owing to economic fears. As such, many car manufacturers are still in the mode of rationalising their existing inventories.