A favourable macroeconomic backdrop and ebbing headwinds on margins and asset quality suggest a more conducive setting for banking stocks performance this year. Yet, 2023’s normalisation of tax rate means RHB expects 2024F sector earnings growth to decelerate to 6% YoY vs 2023F of +11%, and trails their 2024F normalised earnings growth for the FBMKLCI and coverage basket of c.10% YoY.

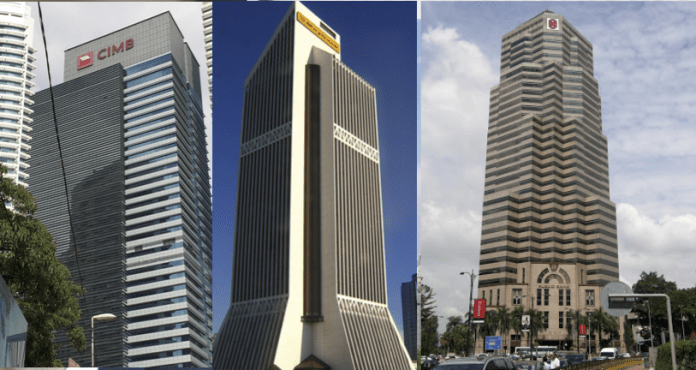

As such, RHB does not see meaningful outperformance overall, and stay NEUTRAL on the sector. RHB’s Top Picks: CIMB, AMMB, Hong Leong Bank and Alliance Bank Malaysia.

RHB Investment Bank Berhad (RHB), in its Malaysia Sector Update today (Jan 22) said the macroeconomic backdrop looks more constructive. RHB Economics is above consensus on GDP growth forecasts for the US and China, which is expected to translate to a rosier backdrop for ASEAN economies.

RHB Economics think the Federal Funds Rate (FFR) has peaked at 5.25-5.50% and pencilled in two rate cuts in 2H24.

Closer to home, Malaysia’s 2024 GDP growth is projected at 4.6% YoY (2023F: 3.8%) while Bank Negara Malaysia is expected to stay pat on the overnight policy rate at 3%.

2024F sector operating income growth to tick up

RHB forecasts 2024 operating income growth of 5% YoY on NII and non-II, as compared to +2% YoY in 2023F on market-led non-II. With sector NIM having compressed by 21bps in 2023F, we expect NIM to stabilise in 2024 on the key assumption that deposits and loan competition stay rationale.

As for loans growth, RHB expects a mild pickup in system loans growth to 4.5-5.0% (2023F: 4-4.5%), led by stronger credit demand from the business segment as global trade improves as well as the roll out of infrastructure projects and initiatives under the various master plans.

Flipside non-II’s pace of growth (2024F: +6% YoY) is unlikely to match the 21% YoY rise seen in 2023F mainly on a moderation in non-fee-based income growth.

Asset quality – RHB stays vigilant but are not overly concerned. During the 3Q23 briefings, some banks shared that GILs and delinquencies may have peaked. Regionally, asset quality has been holding up well in Indonesia and Singapore but we are more guarded in Thailand, particularly on the SME segment. Also, most banks have retained their overlay buffers, which should help cushion against isolated incidences.

At this stage, RHB has not factored in any meaningful overlay writebacks in their numbers, where they project 2024F sector credit cost to ease by 2bps YoY to 27bps.

Back to trend growth. All in, RHB expects 2024F sector PBT to rise by 6% YoY vs 2023F: +2% YoY but bottom line growth is expected to moderate to trend growth of 6% vs 2023F: +11% YoY. Upside risk to earnings could come from lower-than-expected credit cost as better macroeconomic conditions are reflected in banks’ provisioning models while NIM and market-related non-II represent key downside risks at this juncture.

Dividend yield and valuation provide downside support. The sector offers FY24F-25F dividend yield of 5.5-6.0%, which RHB thinks looks decent.

Similarly, the sector is trading at FY24F P/E and P/BV of 10.5x and 1.13x, which are at the -1SD level due to elevated risk premiums. While sector earnings may not look too exciting to meaningfully lift share prices, conversely, RHB thinks downside for the sector should be supported by the abovementioned factors.