CIMB is in the midst of extending its upside movement after it broke past the MYR6 psychological resistance.

RHB Retail Research in a note today (Jan 29) said the counter managed to chart “higher highs” and “higher lows” above the breakout point, thereby affirming the bullish setup.

Riding on the momentum, it should climb towards MYR6.40, followed by MYR6.80.

Towards the downside, falling below the MYR5.80 support will invalidate the bullish setup.

Karex is eyeing a fresh leg on the upside after it underwent a bullish breakout.

The stock has climbed above the MYR0.78 resistance on strong volume, showing that the consolidation phase is now completed.

We observe the volume has been increasing in tandem with share price, showing momentum is gaining speed now.

The stock should scale towards MYR0.84, then MYR0.90.

If it falls below the support of MYR0.72, this would spark the beginning of a correction.

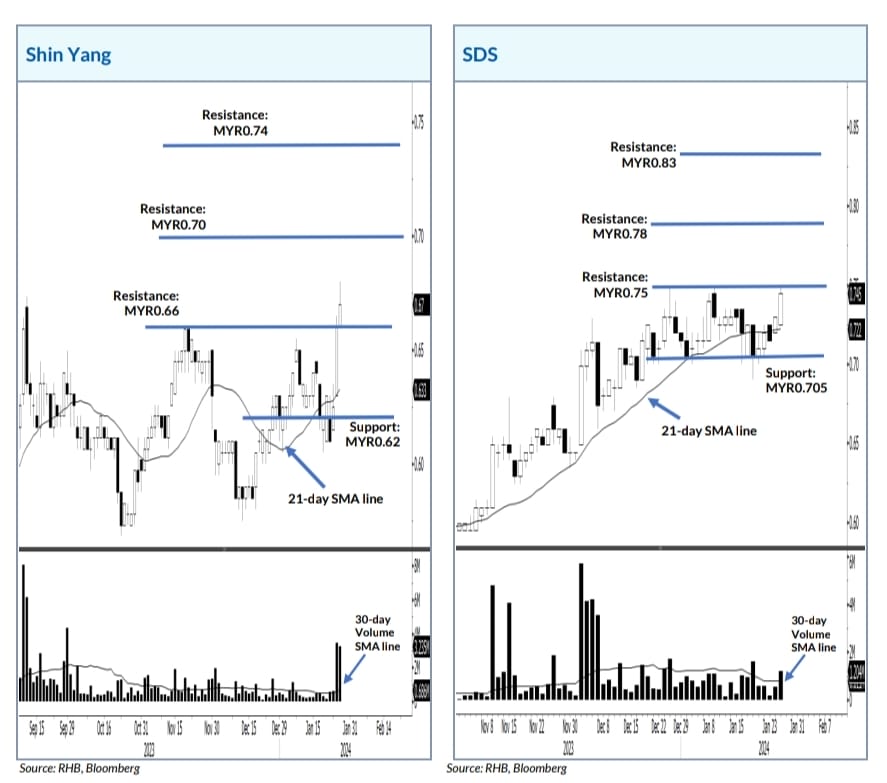

Shin Yang has climbed above a strong resistance, signifying bullish setup is confirmed.

We observe the stock broke past the MYR0.66 resistance on strong volume.

The 21-day SMA line is pointing upwards, showing the short-term trend is bullish.

The bullish momentum should propel the stock towards MYR0.70 mark and followed by MYR0.74.

On the flipside, breaching below the MYR0.62 support will negate the bullish setup.

SDS is attempting to stage a bullish breakout, knocking on the immediate resistance with high volume.

The counter has been moving sideways below the MYR0.75 resistance for consolidation.

If it climbs above the immediate resistance, bullish bias will emerge.

In this case, the momentum would propel the counter towards next resistance of MYR0.78, followed by MYR0.83.

Conversely, falling below the MYR0.705 support would unleash the downward movement.