AMMB Group reported a total income of RM3,476.9 million for the 9 months, a 2.1% YoY decline as NII fell 8.7% to RM2,481.1 million due to NIM compression the group said. However, this was partially offset by a strong 19.2% growth in NoII to RM995.8 million.

The group’s continuing operations income was stable at RM3,425.8 million, NoII grew 26.3% while NII fell 7.2%, growth the group said this was mainly driven by higher trading gains and investment income from GTM, higher fee income from Business Banking, Investment Banking and Retail Wealth Management, as well as improved income from Life and General Insurance.

For the current quarter, revenue came in at RM1.15 billion against RM1.22 billion in the previous Q3, profit however has stable at RM543 million versus RM444 million the bank recorded in Q3FY22.

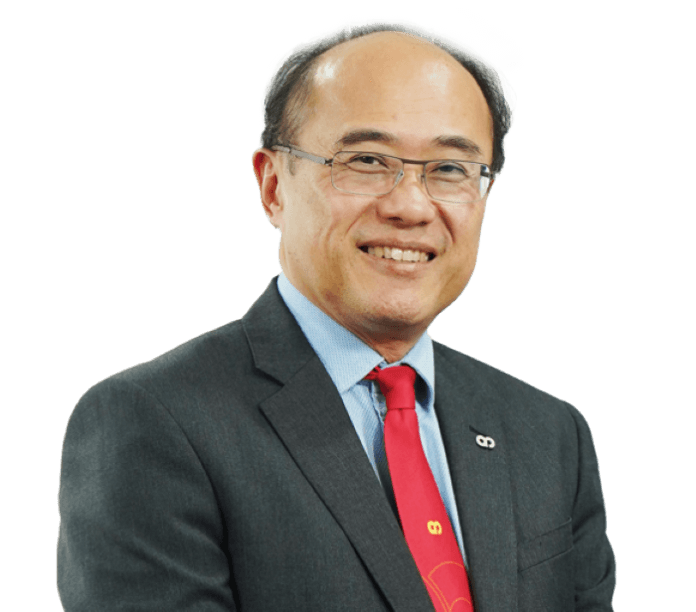

Mr Jamie Ling, who was appointed as the new Group Chief Executive Officer of AmBank Group on 23 November 2023, remarked, “Q3FY24 was a resilient quarter, boosted by the one-off tax credit. We have taken additional prudent overlays to improve the Group’s LLC levels, particularly when the various pandemic- related loan repayment schemes end. As we are in the final year of our FOCUS 8 strategy, delivering an ROE of 10% and the continued strengthening of the Group’s capital ratio positions us well into the future.”