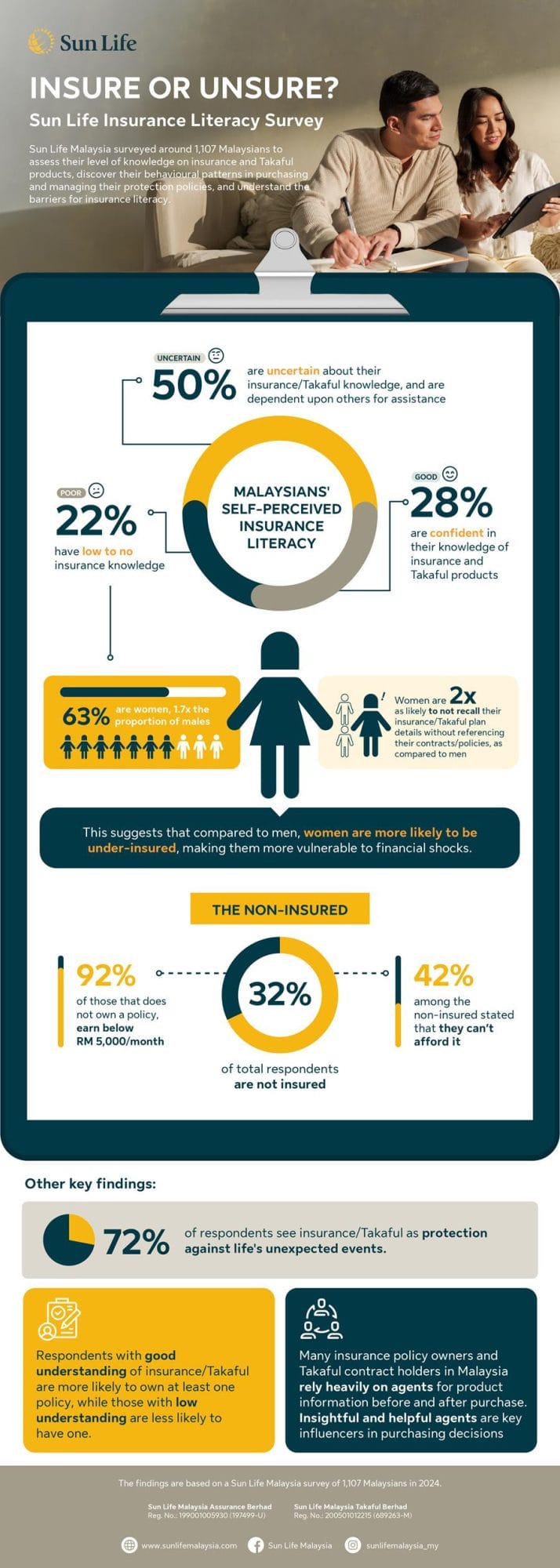

A recent survey conducted by Sun Life Malaysia sheds light on the concerning lack of insurance literacy among Malaysians. The “Insure or Unsure: Sun Life Insurance Literacy Survey” found that only 28% of the 1,107 respondents felt confident in their knowledge of insurance and takaful products. Alarmingly, nearly one-third (32%) of those surveyed admitted to having no insurance protection at all.

The survey aimed to assess Malaysians’ understanding of insurance and takaful products, their purchasing behaviors, and the barriers to improving insurance literacy.

It revealed that women, in particular, are at higher risk of being under-insured compared to men, with 63% of respondents reporting poor self-perceived understanding of insurance topics being women.

Furthermore, the survey showed that many Malaysians, especially those earning below RM5,000 a month, lack insurance coverage despite acknowledging its importance in providing financial protection against unexpected life events.

Sun Life Malaysia, CEO and President/Country Head of Sun Life Malaysia, Raymond Lew, expressed concern over these findings, emphasising the importance of insurance literacy in ensuring financial stability during unpredictable times.

He stressed that acquiring the necessary knowledge and skills to manage finances and plan for the future is crucial in today’s economy.

The survey also highlighted that respondents with moderate to high self-perceived understanding of insurance were more likely to own insurance policies or takaful contracts.

Conversely, those with low understanding were less likely to have any form of insurance coverage.

To address the gaps in insurance literacy, Sun Life Malaysia launched the InsureLit Campaign. This initiative aims to empower Malaysians with essential insurance knowledge through various educational initiatives, both online and in-person.

One such initiative is the introduction of the “Earn Save and Protect” board game, designed to impart financial knowledge in an engaging manner.

Overall, the survey findings underscore the importance of improving insurance literacy among Malaysians to enable them to make informed decisions about their financial futures.

Through initiatives like the InsureLit Campaign, Sun Life Malaysia is taking proactive steps to bridge the gap and empower individuals to achieve financial security.