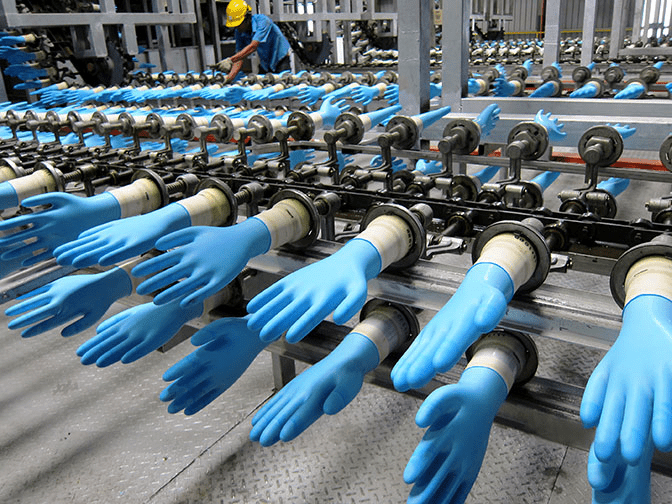

After a disappointing quarter, an analyst expects Top Glove Corporation Bhd’s turnaround to require a longer time owing to subdued plant utilisation rate as well as lower ASP profile than its peers.

RHB Investment Bank (RHB), in its Malaysia Company Update today (Apr 2), said their TP incorporates a 2% ESG premium (from -2% previously) after they raised its E-score following the group’s inclusion on the Dow Jones Sustainability Index for five consecutive years. \

ASP. Industry-blended ASPs have held up at USD20 per 1,000 pieces from USD19-20 previously (although nitrile ASP was relatively lower, at USD17-18 vs latex glove at USD20).

According to RHB’s channel checks, Chinese glove makers’ ASPs are expected to increase to USD16-17 from USD15-16.

The continued narrowing of the ASP gap means the prolonged price war is approaching its tail-end – allowing Malaysian manufacturers to compete via product quality rather than price.

Demand. Malaysia’s gloves export volume spiked 6% MoM (+2% YoY) in Feb 2024, continuing its MoM growth for two consecutive months.

Export value grew 7% MoM (+11% YoY), with MoM growth surpassing export volume growth – indicating that cost pass-through is picking up gradually.

Meanwhile, China glove exports contracted 15% MoM in Feb, following a 4% MoM growth in Jan.

RHB maintains their 2024 global glove demand growth of 7%, premised on the recovery of glove restocking activities in 2H24.

Supply. Following a period of consolidation, RHB estimates the global glove effective capacity to be reduced by 53.4bn in 2023 (with 40bn, 13bn, 3bn, and 5bn from Top Glove, Hartalega (HART MK, BUY, TP:MYR3), Kossan Rubber (KRI MK, BUY, TP:MYR2.20), and Supermax Corp (SUCB MK, BUY, TP:MYR1.03); offset by 3bn in newly-added capacity from Chinese glove makers ie Intco Medical Technology and 4.6bn in planned capacity expansions from Thailand.

RHB expects a marginal change in the global industry supply to 2bn planned capacity replenishment by HART (commissioning of NGC 1.5 production line by 2H24) and 1.1bn planned capacity by Sri Trang Gloves.

Earnings revision and valuation. RHB has left their earnings estimates unchanged but raise their required return assumption to 9% from 8% to factor in: i) Slower-than-peers in turning profitable; ii) being the weakest balance sheet among the top-5 players; and iii) commanding the lowest blended ASP. ]

RHB’s TP implies 1.2x FY24F P/BV vs the 1.5x industry average, given TOPG’s subdued profitability and balance sheet.

Key risks. Decrease in gloves ASP, slower-than-expected demand recovery, lower-than-expected utilisation rate, and higher-than-expected raw material price.