Capital Markets Malaysia (CMM), an affiliate of the Securities Commission Malaysia (SC) in collaboration with the Climate Bonds Initiative (Climate Bond) launched its interactive Transition Strategy Toolkit (toolkit) aimed at supporting local and regional efforts towards the global net zero goal by leveraging transition finance amongst mature and mid-tier corporates.

The toolkit is designed to offer corporations in ASEAN seeking to attract capital for their transition needs with insights on building credible science-based climate transition plans that are aligned to the Paris Agreement targets or respective national climate goals.

The toolkit details the underlying principles and elements to be incorporated when developing climate transition plans, by guiding users through the Climate Bonds Five Principles for an ambitious transition, enabling investors to easily identify investments that support a low-carbon transition.

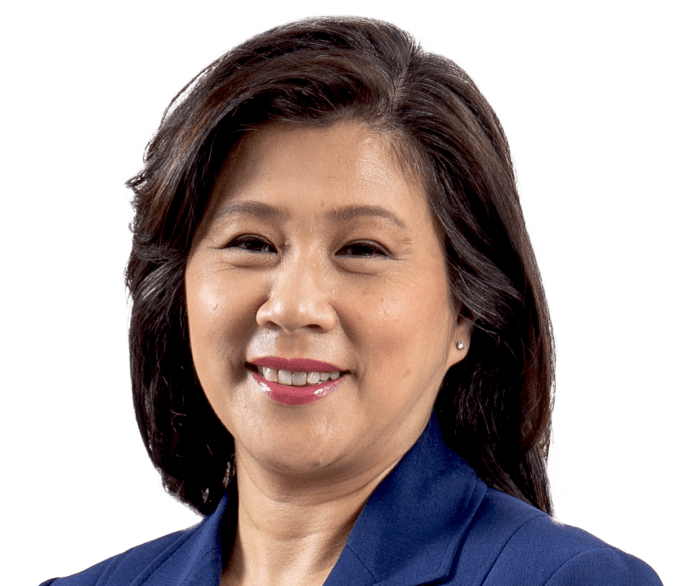

Datin Azalina Adham (main pic), Managing Director of the SC and Board Member of CMM said, “The Transition Strategy Toolkit takes a consultative approach in offering guidance to corporations operating across ASEAN as it is designed to consider the specific nuances of decarbonisation goals of each ASEAN country, while providing a benchmark against the Climate Bonds Initiative’s ambitious transition methodology.

“Malaysian corporates embarking on their transition strategies, financial institutions offering transition financing and institutional investors looking to invest in credible transition projects will find the Toolkit useful in identifying and assessing plans, targets and goals that meet globally accepted transition principles.

“The launch of this Toolkit builds on the SC’s continued efforts to support Malaysia’s carbon neutral aspirations laid out in recent policy initiatives such as the National Industrial Masterplan 2030 and the National Energy Transition Roadmap by providing best practice guidance to corporations seeking to attract capital for transition projects that will advance our national climate agenda. While we progress on our journey to carbon neutrality, it is important to ensure that the principles for a just transition are adhered to,” she added.

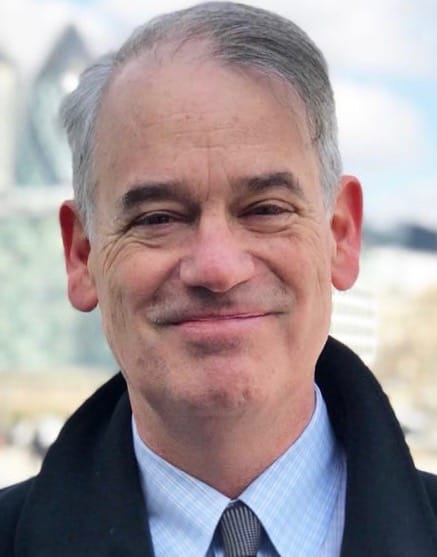

CEO and Founder of Climate Bonds, Sean Kidney (pic, above) said, “We are delighted to collaborate with CMM to develop this toolkit for ASEAN corporations. Transition plans are essential in the journey towards the Paris goals. They must be built on clear targets, effective strategies, ample financial support, and unwavering leadership. Harmonisation of key principles underpinning transition plans will encourage the flow of green capital to ASEAN businesses.”

The web-based Toolkit utilises an interactive question and answer (Q&A) interface that begins with a risk assessment supported by key definitions and the CBI methodology to offer essential and systematic guidance on areas to consider when developing comprehensive transition plans.

By going through the interactive Q&A, businesses will be able to determine where they stand and identify key areas to address to achieve the 5 Hallmarks that are fully aligned with and build on the thematic guidelines from the International Capital Market Association (ICMA), as well as the disclosure requirements from the Task Force on Climate-Related Financial Disclosures (TCFD).

The hallmarks include Paris-aligned performance targets, robust plans with a clear step-by-step qualitative implementation plan towards targets, actions being implemented with identified metrics and indicators to assess delivery, governance of accountability mechanisms and leadership systems needed to drive the transition as well as transparent disclosures for credibility and comparability across national and global peers.

In conjunction with the launch of the toolkit, CMM hosted a webinar on Transition Finance in ASEAN on 27 March featuring speakers from the Climate Bonds Initiative, UK Transition Plan Taskforce (TPT) and the Securities Commission Malaysia, highlighting recent global initiatives in supporting transition finance.