CIMB Group, through its entities CIMB Bank Berhad (“CIMB Bank”) and CIMB

Islamic Bank Berhad (“CIMB Islamic”) have entered into a strategic partnership with Credit

Guarantee Corporation Malaysia Berhad (“CGC”) to provide small and medium enterprises

(“SMEs”) access to RM2 billion in financing through CGC’s Portfolio Guarantee-i scheme.

The strategic partnership was signed by KJ Balan, Head, SME Banking Malaysia, Group

Commercial Banking, CIMB Bank and Leong Weng Choong, Chief Business Officer of CGC,

witnessed by Dato’ Mohamed Ross Mohd Din, Chairman of CIMB Islamic Bank Berhad; Rafe

Haneef, CEO, Group Islamic Banking, CIMB Group; Ahmad Shazli Kamarulzaman, Deputy CEO, Group Commercial Banking, CIMB Group; Choong Tuck Oon, Director, CGC, Datuk Mohd Zamree Mohd Ishak, President/CEO, CGC and Rahim Raduan, Chief Corporate Officer, CGC.

This financing scheme will see CIMB Bank and CIMB Islamic disburse up to RM2 billion through Portfolio Guarantee-i, an Islamic working capital financing where 70 percent of the loan amount is guaranteed by CGC, without collateral. Financing amount is up to RM1 million per customer, with maximum tenure of seven years.

Victor Lee Meng Teck, CEO of Group Commercial Banking, CIMB Group, said, “We’re pleased to partner with CGC in nation building as SMEs are projected to contribute 41 percent to Malaysia’s GDP by 2020. CIMB is also committed to support the SME industry not only in Malaysia, but also across ASEAN, powered by CIMB’s 800 branches and 2,000 relationship managers.

“In line with CIMB’s next mid-term growth plan, our refocused proposition includes an investment of more than RM300 million in the next five years to strengthen our end-to-end tech-driven SME banking solutions to help transform our customers’ business.”

Datuk Mohd Zamree Mohd Ishak, President / CEO of CGC, said, “I am pleased to share that

over the last six years, both CIMB and CGC have successfully launched 13 Portfolio Guarantee Schemes totalling RM1.4 billion, benefiting over 2,000 SMEs.”

CIMB Bank recently announced its commitment to disburse at least RM15 billion in the next two years to help 100,000 SMEs in Malaysia, particularly for financing below RM500,000, in support of the government’s push for an entrepreneur-friendly enabling environment to boost Malaysia’s economy.

CIMB Bank disbursed a total of RM17.8 billion in 2016-2018 to support the growth of 17,000 Malaysian SMEs by providing working capital, asset financing and trade finance. Its latest offerings include leveraging business assets as additional working capital; and extending unsecured loans to SMEs who are awaiting their GST refund. The latter is offered at a lower interest rate, with a flexible payment period and interest servicing up to six months, to help small businesses manage their cash flow.

CIMB also sees huge potential in its unique halal corridor proposition, with its strong ecosystem and regional network that could support SMEs’ venture into the export market beyond Malaysian borders. Focusing on agribusiness, cosmetics, F&B, modest fashion and pharmaceuticals, CIMB’s halal corridor proposition is poised to help SMEs access, for example, the ASEAN-China corridor with a combined customer base of 266 million Muslims.

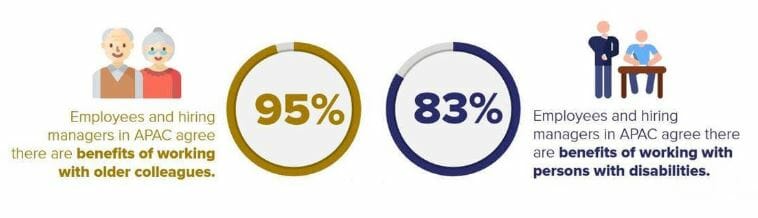

Malaysians are optimistic about having a more inclusive workforce according to PERSOLKELLY’s latest Asia Pacific (APAC) First Quarter Workforce Insights report.

Malaysians are optimistic about having a more inclusive workforce according to PERSOLKELLY’s latest Asia Pacific (APAC) First Quarter Workforce Insights report.