Mi 8 Pro is one of the first to feature pressure-sensitive in-display fingerprint sensor and Mi 8

Lite is a selfie machine that sports a stunning gradient glass back finish

Global technology leader Xiaomi announced the Mi 8 Lite and Mi 8 Pro in Malaysia, giving users more ways to enjoy the best features from the Mi 8 series.

Xiaomi has shipped more than 100 million smartphones in this year with a total shipment over 6 million and the Mi 8 series has been a major contributor to this success. Both Mi 8 Pro and Mi 8 Lite are welcomed additions to this flagship smartphone series.

Steven Shi, Xiaomi Regional President of Southeast Asia and Oceania,said: “We are delighted to introduce the newest members of the Mi 8 family to Malaysia. We offer more choices for users to enjoy the popular Mi 8 series simply because we want smartphone users to be able to find their ideal smartphone that cater to their needs and interests. For tech connoisseurs, the Mi 8 Pro keeps them excited with its futuristic features and design. For those who wants to take selfies in style, we have designed the Mi 8 Lite specifically for them.”

Mi 8 Pro: Flagship Performance With Innovative and Futuristic Design

On top of the flagship Mi 8 features, Mi 8 Pro takes it one step further with a pressure-sensitive in-display fingerprint sensor. The all new pressure-sensitive in-display fingerprint sensor give the Mi 8 Pro a star for enabling a faster and more power-efficient unlocking process. Unlike other technologies, the unlocking process only respond to the dedicated pressure and is activated when a finger is placed on the screen.

Mi 8 Lite: Amazing Selfies With Eye Catching Gradient Finish

With over 24 million pixels, the front-facing Sony IMX576 sensor on Mi 8 Lite is able to capture images in great detail. The Super Pixel technology, a combination of four pixels into one large pixel, allows for vivid low light photography. This means no more worries of pictures looking dull and blurry at night. Meanwhile, the Mi 8 Lite display can light up in different colors to suit different scenarios when taking selfies, intelligently illuminating the face with the right color temperature for great-looking selfies.

Inspired by the works of famous French Impressionist painter Claude Monet, whose paintings are renowned for bringing out the effect of light on natural colors, the glass back of Mi 8 Lite employs an advanced NCVM color process, resulting in a mesmerizing mirror-like gradient finish.

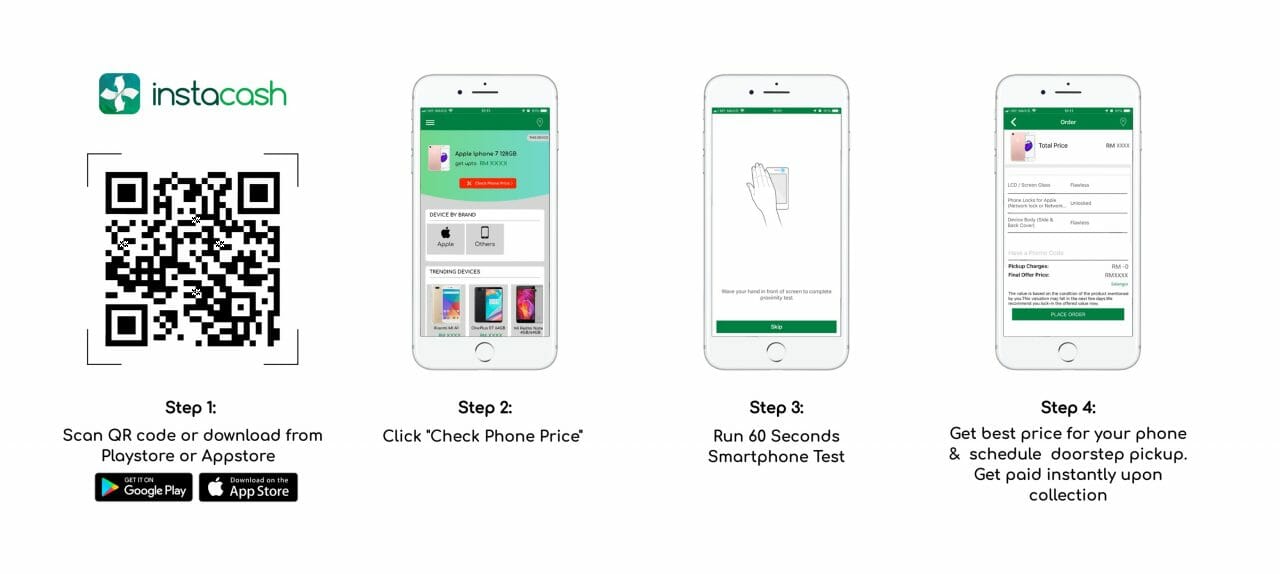

InstaCash Malaysia spokesperson Mr. Henry Ng in sharing about the background said, “Initially launched in the Klang Valley, InstaCash now supports Malaysians nationwide to trade-in their phones for a hassle-free experience. Once a customer has completed their transaction with the InstaCash App, they are contacted, and a courier would be assigned to collect the phone within 24 hours.

InstaCash Malaysia spokesperson Mr. Henry Ng in sharing about the background said, “Initially launched in the Klang Valley, InstaCash now supports Malaysians nationwide to trade-in their phones for a hassle-free experience. Once a customer has completed their transaction with the InstaCash App, they are contacted, and a courier would be assigned to collect the phone within 24 hours.