The Malaysia Securities Commission (SC) continuously strives to safeguard the interests of investors. Through its gate-keeping and rule-making functions, the SC hopes to promote good conduct and governance among capital market intermediaries and listed corporations.

In recent times, there has been a great deal of concern about the rising number of scams and unlicensed activities in the capital market.

What are Clone Firm Scams?

These are cases where investment scams were perpetrated by the scammers impersonating:

– The SC’s licensed or registered intermediaries;

– Legitimate entities licensed or authorised by other local or foreign authorities / regulators; or

– Companies incorporated locally or overseas.

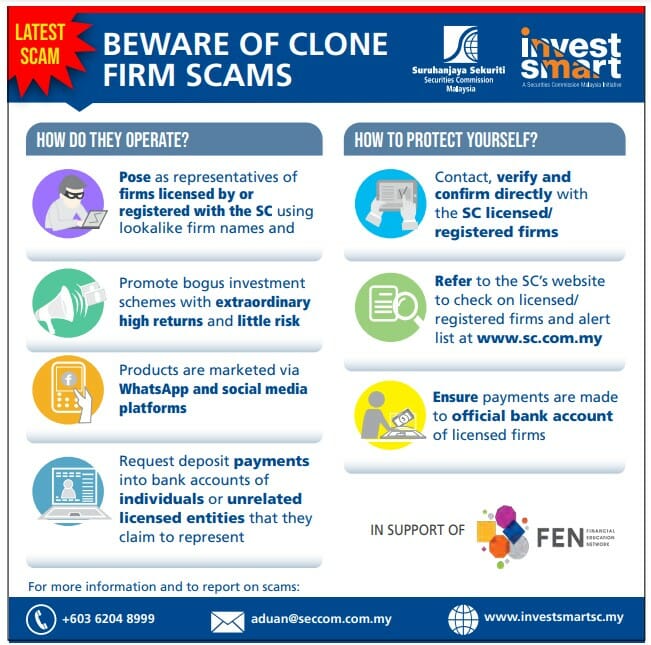

These types of scams are known as clone firm scams. Their modus operandi is similar to investment scams, with the additional feature of the scammer impersonating a legitimate entity to lend credence to their illegal enterprise.

If a fraudulent company wants to set itself up to look like a capital market intermediary that is licensed by or registered with the SC, the fraudsters will use the names, logos, credentials, websites, and other details of a legitimate capital market intermediary to promote bogus investment schemes via social media channels, promising extraordinarily high returns with minimal to no risks.

Unlicensed Activities

Unlicensed activities are regulated activities carried out by persons in Malaysia without the requisite licence or registration. Subsection 58(1) of the Capital Markets and Services Act 2007 (CMSA) requires a person to hold a CMSL or be a registered person to carry on a business in any regulated activity or hold himself out as carrying on such business.

There are eight types of regulated activities, and they are contained in Schedule 2 of the CMSA which includes dealing in securities, dealing in derivatives, fund management and investment advice.

Subsection 58(4) of the CMSA further provides that any person who carries on the business of a regulated activity without a licence or registration commits an offence and shall, on conviction, be liable to a fine not exceeding RM10 million or to imprisonment for a term not exceeding 10 years or to both.

Separately, those who engage in operating a peer-to-peer financing platform, equities crowdfunding, digital asset exchange (DAX) or initial exchange offering, must be registered as a recognised market operator with the SC under section 34 of the CMSA.

The SC regularly receives complaints and enquiries on various types of unlicensed activities which may not necessarily be scams. While some of the unlicensed activities are carried out locally by Malaysians with local presence, there are also foreign entities carrying on unlicensed activities in Malaysia.

These foreign entities may be properly licensed or regulated by foreign regulators.

However, they would still be breaching Malaysian laws if they carry out their activities in Malaysia, solicit clients in Malaysia or have a local presence in Malaysia without the requisite licence from or registration with the SC.

Common Complaints

Some of the more notable complaints and enquiries received by the SC on unlicensed activities are set out below.

Unlicensed Investment Advice

Throughout 2019 to 2021, the SC received 104 complaints and enquiries on unlicensed investment advice and had subsequently made various interventions including enforcement actions.

Interventions by the SC

In view of the growing concerns of investment scams and unlicensed activities, the SC has taken the measures outlined below.

Enforcement Actions

In 2021, 41% of completed investigations belonged to offences in relation to unlicensed activities. The SC also established a taskforce to investigate investment scams and clone firms which reviewed 159 bank accounts that identified 32 persons of interest.

Additionally, five enforcement actions were also taken against operators of unlicensed activities.

Placement on the SC Investor Alert List

From January 2021 to December 2021, 275 entities were placed on the SC’s Investor Alert List6for carrying out investment scams or unlicensed activities. This amounts to a total of 680 entities/individuals placed on the SC’s Investor Alert List as at 31 December 2021.

Issuance of Cease-and-Desist Directive

The SC issued 25 notices of cease and desist to unlicensed operators, directing them to cease their offering in Malaysia.

Blocking of Websites

The assistance of the Malaysian Communication and Multimedia Commission (MCMC) was sought to block 143 websites found to be involved in scams or unlicensed activities.

Reporting to Social Media Platforms

The SC has also consistently written to several social media platforms such as Facebook, Instagram, and Telegram to report the page/group used by scammers or unlicensed operators to promote their services.

Police Report

A total of 53 police reports were lodged for the misuse of the SC’s name or logo in the marketing materials or websites involving investment scams.

Media Release

Periodically, the SC issues media releases to warn the public of any emerging concerns on scams and unlicensed activities such as the media releases warning the public on clone scams and those perpetrated through Telegram.

Referral to Local and Foreign Regulatory Agencies

A total of 149 cases involving investment scams and unlicensed activities operators were referred to local and foreign regulatory agencies.

Social Media Intervention

The SC adopted a social media intervention strategy to publicly post messages or caution statements on the social media pages of investment scams and unlicensed activities operators. These postings are made in reference to the SC’s licensing requirements and the punishment for breach of securities laws.

Investor Education

The SC’s investor empowerment initiative, InvestSmart®, carried out various activities to promote investment literacy and awareness on unlicensed activities and scams to members of the public.

Amid the COVID-19 pandemic, InvestSmart® continued to utilise various digital and online tools including social media channels like Facebook, Instagram, Twitter, and YouTube to reach out to the Malaysian public with timely alerts, reminders, and guidance to avoid unlicensed activities and scams.

Also Read: Have You Been Scammed?’ – SC Reports An Alarming 93% Increase From 2021