The FBM KLCI opened higher at 1,450.68 as compared yesterday’s 1,443.50.

At the time of writing, the main index oscillated in the range of 1,450.68 – 1,456.80.

At around 2am, UMNO has released its official statement that Barisan Nasional (BN) will not cooperate with Perikatan Nasional (PN). With the heightened hope that political limbo may be coming to an end, investors might bargain-hunt at this point. Hence, the KLCI is edging higher at the time of writing.

RHB Research maintains long positions on FKLI.

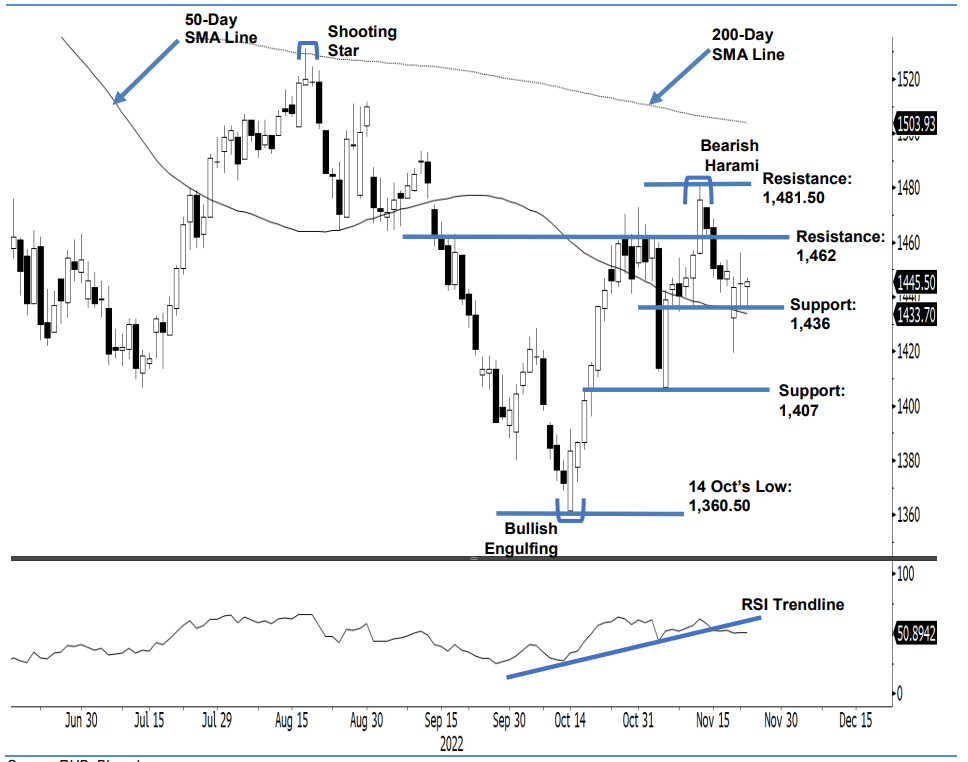

Despite facing selling pressure, the FKLI managed to retain its position above the 50-day SMA line and closed at 1,445.50 pts. Yesterday, the index started off the session at 1,444 pts. Initially it fell to the day’s low at 1,435 pts on selling pressure. The index staged a rebound in the afternoon to close at 1,445.50 pts – forming a long lower shadow above the 50-day SMA line. The price action suggests the 50-day SMA line remains as a strong support. As long as the index continues to trade above the moving average line, the bullish setup is deemed valid. Otherwise, falling below the threshold would negate the setup and attract strong selling pressure. For the coming sessions, the index should consolidate above the moving average line, eyeing to resume the upside movement. RHB Research is keeping its positive trading bias until a bearish breakout happens.

Traders should keep the long positions initiated at 1,475.50 pts, or the closing level of 11 Nov. To manage the

trading risks, the initial stop-loss is placed at 1,436 pts.

The immediate support stays at 1,436 pts – 10 Nov’s low – and is followed by 1,407 pts, or the low of 4 Nov. Meanwhile, the immediate resistance is pegged at 1,462 pts – 2 Nov’s close – and then 1,481.50 pts, or the high of 11

Nov.

For the latest Business News and happenings, follow BusinessToday on Twitter