With the macroeconomic and domestic political scene seemingly reaching inflection points, Mr Market may have more reasons to be less pessimistic, notwithstanding the prevailing challenges.

At the current below-mean valuation, RHB Research in its research report give this investment advice: Investors should continue to position for 2023 as ongoing positive alpha generation exists, even in a challenging market, as seen in the outperformance of RHB’s 20 Jewels 2022 Edition.

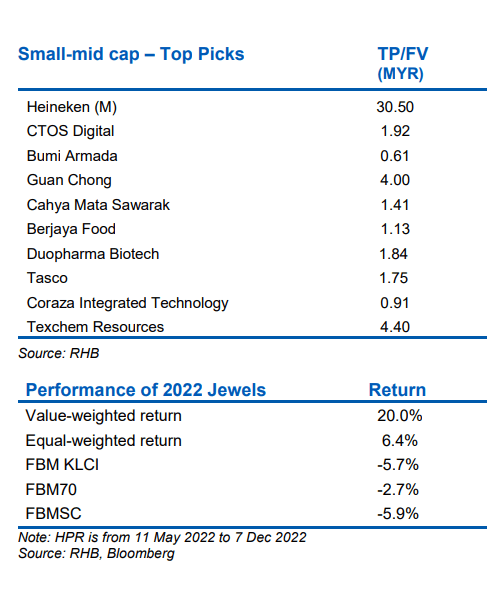

RHB Research believes value stocks will take centre stage in a quantitative tightening cycle while sector rotational play should also be kept in check. Its ideas are focused on domestic play, inelastic demand, low prevailing valuations, and unique turnaround/growth catalysts.

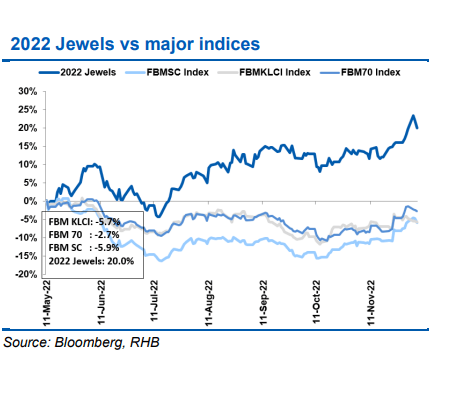

RHB Top 20 Malaysia Small Cap Companies Jewels 2022 outperformed the broader market with a value-weighted holding period return of 20%, since its book launch on 12 May 2022 vs returns of benchmarking indexes – FBM 70 (decline 2.7%) and FBM SC (decline 5.9%) – despite the extremely volatile market given various uncertainties in the external environment. The number of winners-losers were split by 50-50, with the winners mainly from the oil & gas, healthcare, consumer and industrial sectors.

Encouraging rebound lately. As the dust settles in the domestic political scene (at least for now), potential signs of the peaking of inflation and interest rate hike cycle, coupled with the progressive reopening of China’s lockdown, the local bourse has come to life after being dreadful for the large part of the year, with the FBM KLCI staging a relatively strong rebound of 6.7% from a 6-month low in Oct 2022, and the FBM 70 and FBM SC following suit to recoup

some losses.

To date, the FBM SC has outperformed the FBM KLCI (which declined 3.8%) thanks to the strong run for chemical, consumer and oil & gas counters. The relative weaker performance of FBM 70 (declined 9.2%) compared to the FBM KLCI is due to the de-rating of technology and glove related stocks for the former and the outperformance of banking stocks and net foreign inflow for the latter.

Lacklustre market activity marks a downbeat 2022. The lack of market liquidity this year was dragged by the lack of retail participation, risk-averse sentiment, unfavourable macroeconomic conditions, and compounded by the resumption of intra-day short selling (IDSS).

Both local institutional and retail investors stayed on the sidelines for most part of the year as sentiment reached rock bottom.

Trading activity for the FBM 70 and FBM SC saw a clear down-trending effect from the lack of robust retail participation after two elevated years in 2021-2022. YTD total turnover (traded value) contracted by 6%, 39% and 63% for the FBM KLCI, FBM 70 and FBM SC as retail participation dropped to 26% YTD from 37% in 2021.

Narrower valuation gap. While the FBM 70 and FBM SC are trading at below their 5-year mean at 13.5x and 10.7x, the valuation gap of small-mid caps to the big caps, based on RHB’s stock coverage universe, has narrowed to 1.2x showing similar strong appetite in the small-mid cap space given its unique exposure or growth story despite the general preference over large cap value stocks in the current market environment.

Interestingly, valuation of the MSCI Malaysia Small Cap Index is on par with the MSCI benchmark index with a similar elevated valuation trend observed for the MSCI small-cap indexes in markets like Japan, Singapore and Thailand.

More reasons to be less pessimistic. Hence, the research house has advocated investors to focus on value stocks with a healthy cash flow generation and dividends that offer a compelling valuation that will grow and prevail under the current challenging environment. A reasonable valuation would, in turn serve as a buffer should there be any miss in earnings forecast due to the uncertain overall macroeconomic environment.

The sector preference in the small-mid cap space includes consumer staples, consumer discretionary, healthcare, technology, logistics and oil & gas.

Risks identified include economic recession, inflation, delay in China’s reopening, earnings

disappointment, liquidity issues, political instability, and ESG-related risks.