RHB Retail Research has reiterated its long positions on HSI Futures.

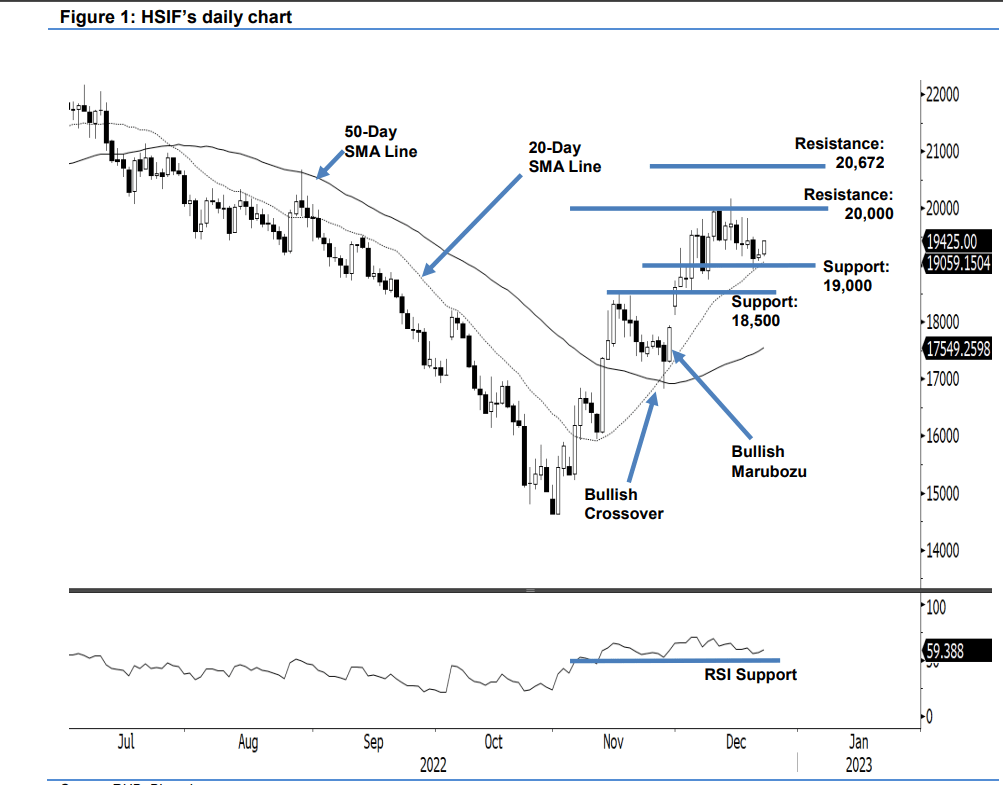

After falling from the 20,000-point mark for the past four sessions, the HSIF attempted to rebound higher yesterday, inching up a moderate 57 points before closing at 19,181 points and rebounding higher from the 20-day average line.

The index opened on a neutral tone at 19,130 points and oscillated between the 19,080-point low and 19,292-point high, which saw it retrace before closing above the opening level. In the evening, the HSIF climbed a strong 244 points and last traded at 19,425 points.

Yesterday’s small white candle following the recent pullback signals that the profit-taking momentum has eased, with the index likely to demonstrate an upward rebound in the later sessions. With the RSI improving towards the 60% level, it is likely see the HSIF to at least trade sideways above the 20-day SMA line in the near term, with the upside bias towards reclaiming the 20,000-point mark in the medium term.

As the downside risks have been minimised, the research house has continued to keep to its bullish bias.

Traders should remain in the long positions initiated at 18,617 points or 30 Nov’s close. To minimise trading risks, the trailing-stop threshold is set at 19,000 points.

The immediate support is revised higher to 19,000 points and followed by 18,500 points. The first resistance stays at 20,000 points, followed by 20,672 points, which was the high of 29 Aug.