RHB Retail Research has retained its long positions on HSI futures.

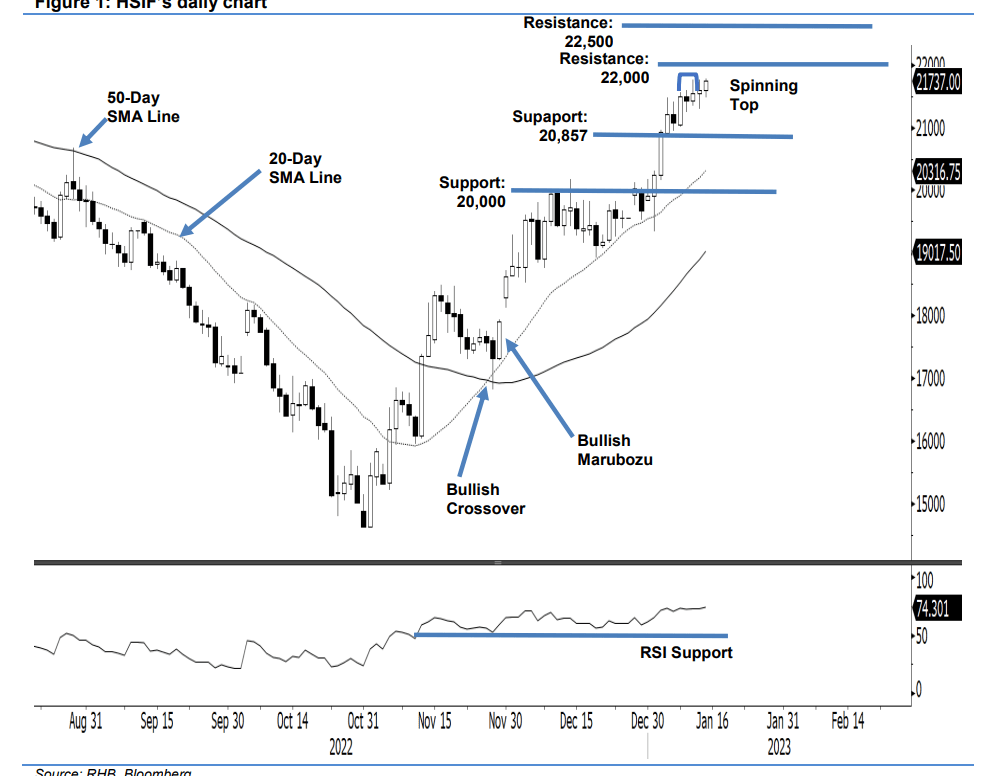

Despite the HSIF undergoing a volatile session yesterday, it managed to close higher at 21,589 points. After opening at 21,550 points, the index whipsawed between 21,769 points and 21,292 points before closing at 21,589 points. In the evening session, the index climbed 148 points and last traded at 21,737 points.

Observe the latest session’s trading range is getting wider, indicating that the index is poised to stage a larger movement. It may resume an upside movement and climb towards the 22,000-point resistance. If this happens, it will negate the Spinning Top. On the flip side, breaching below 20,857 points would indicate that the bears have regained control. Falling below the 20-

day SMA line would trigger a deeper correction.

At this juncture, the index continues to chart a “higher high” as the bullish momentum has regains its pace. The research house is sticking to its positive bias until a bearish breakout happens.

Traders are advised to keep the long positions initiated at 18,617 points (30 Nov’s close). To manage the downside risks, the stop-loss is set at 20,857 points.

The immediate support is marked at 20,857 points (5 Jan’s low), followed by 20,000 points. Conversely, the immediate resistance is eyed at 22,000 points, followed by 22,500 points