The FBM KLCI slid lower and opened at 1,487.82 as compared to last Friday’s close of 1,490.47.

At the press time, the main index was traded in the range of 1,483.09 – 1,487.99.

At 9: 11am, the index dropped further down by 7.21 points or -0.48% at 1,483.26.

The KLCI slid lower at the opening as it weighed down by Sino-US Tension as well as the negative cue of Wall Street overnight.

RHB Retail Research has reiterated its long positions on FKLI.

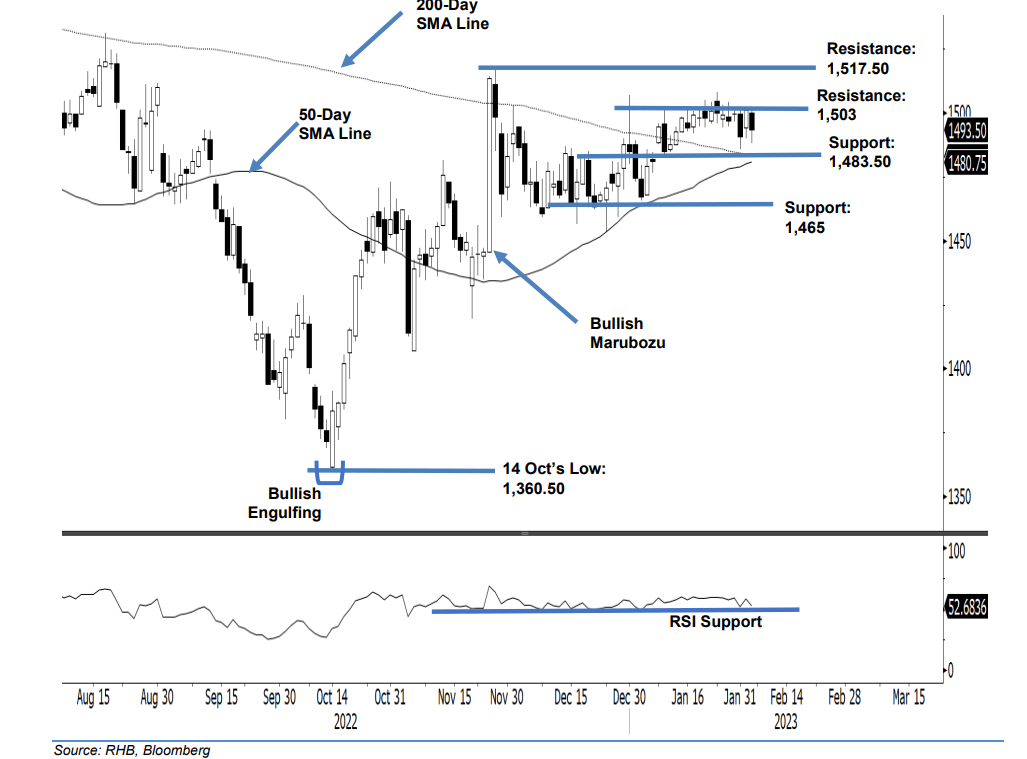

The FKLI failed to extend the bullish momentum last Friday, and shed 7.50 points to close at 1,493.50 points. It opened at 1,500-point, printed the day’s high of 1,501 points then progressed lower throughout the session, hitting the day’s low of 1,488 points before closing at 1,493.50 points – as such, a fresh bearish candlestick emerged. The latest bearish candlestick has engulfed Thursday’s bullish candlestick, indicating that sentiment is turning negative now.

In the event the selling pressure increases and the index breaches the 1,483.50-point support, this would attract strong follow-through negative momentum. Before this happens, we think the bulls will attempt to stage a rebound near the 200-day and 50-day SMA lines. Both moving average lines are providing support now. At this juncture, the research house will maintain a positive trading bias until the immediate support gives way.

Traders should stick to long positions initiated at 1,475.50 points (11 Nov’s close). To minimise the downside risks, the stop-loss is set at 1,483.50 points.

The immediate support is at 1,483.50 points – 10 Jan’s low – followed by 1,465 points ie the close of 15 Dec 2022. The immediate resistance remains at 1,503 points – 1 Dec 2022’s high – followed by 1,517.50 points or the high of 25 Nov 2022.