After a minor pause, the HSIF is seen gaining negative momentum as it retreated 80 pts and closed at 21,259 pts. Yesterday, the index initially opened at 21,356 pts and rose towards the session’s high at 21,495 pts. However, it then pulled back to the session’s low of 21,113 pts before closing at 21,259 pts.

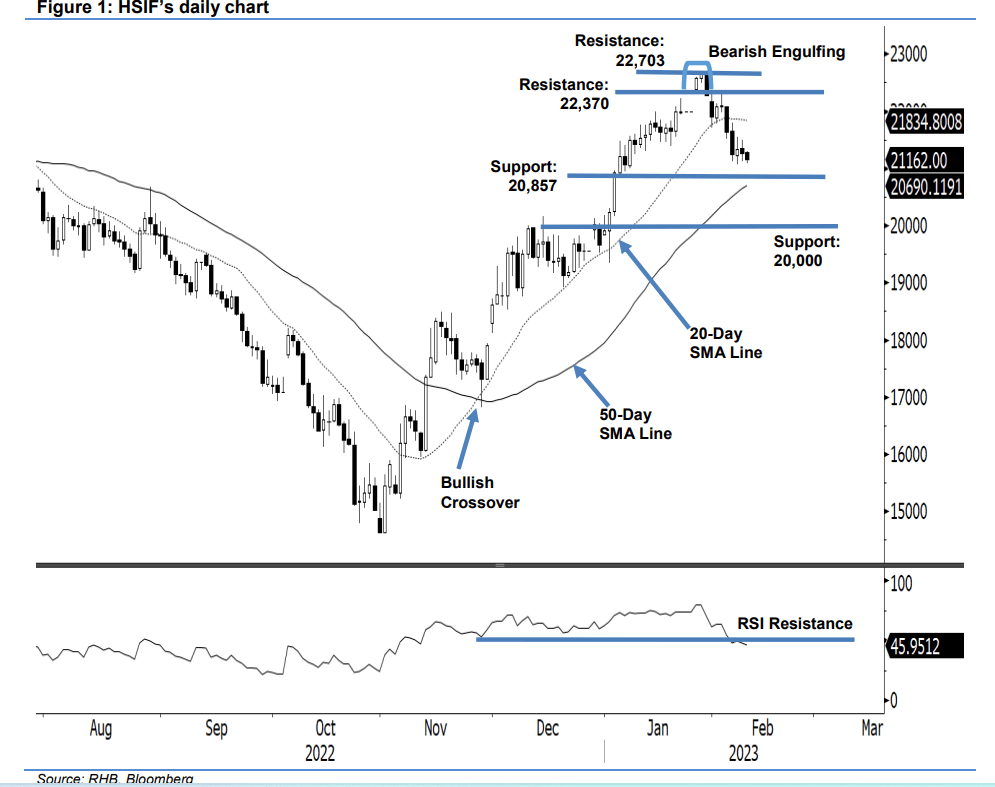

In the evening, the index fell 97 pts and last traded at 21,162 pts. From the chart we see the 20-day SMA line is turning lower, exerting additional selling pressure on the index. Observe that since forming the YTD high at 22,703 pts on 30 Jan, the index has been trending downwards on “lower highs” and “lower lows”, showing the bearish structure has formed.

In the event the index fell below the 20,857-pt support, this will improve the bearish setup and attract strong selling pressure. We keep our view that as long as the index stays below the 20-day SMA line, the bears will have an upper hand. Since the bearish momentum is accelerating again, RHB Retail Research is holding on to its negative trading bias. Hence, it is maintaining short positions.

We advise traders to keep the short positions initiated at 21,643 pts (3 Feb’s close). To manage the trading risks, the initial stop-loss is fixed at 22,370 pts.

The immediate support is located at 20,857 pts (5 Jan’s low), followed by 20,000 pts. Meanwhile, the immediate resistance remains at 22,370 pts – 2 Feb’s high – followed by 22,703 pts, or the high of 30 Jan.