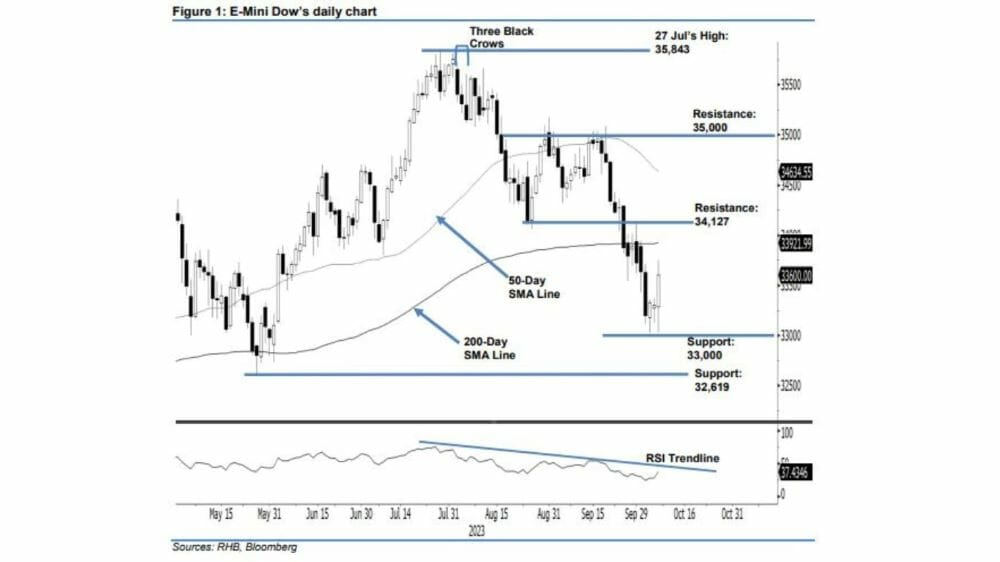

The E-Mini Dow’s price recorded a notable resurgence on Friday (Oct 6), as it surged by 296 points to close at 33,600 points, says RHB Investment Bank.

The research house said the rebound has strengthened the support base at the 33,000-point level and suggests the potential for a rebound toward the 50-day Simple Moving Average (SMA) line.

The day began with index futures opening lower at 33,291 points and briefly touching a low of 33,032 points before witnessing robust buying activity.

The market then rallied strongly for the remainder of the session, reaching a peak of 33,756 points before experiencing a moderate retracement at the close.

The presence of a strong bullish candlestick above the 33,000-point support level indicates the likelihood of sideways consolidation in the coming sessions.

Besides, there is potential for an upward move towards the immediate resistance level of 34,127 points, which is located above the 50-day SMA line.

However, should the E-Mini Dow fail to breach the 50-day SMA line, the medium-term bearish outlook remains intact, with a focus on dropping below the 33,000-point level.

Despite the recent robust rebound, the overall medium-term outlook retains a bearish bias, unless the immediate resistance level is successfully breached.

Traders are advised to adhere to short positions initiated at 35,312 points on August 3. To manage trading risks effectively, the trailing-stop threshold has been adjusted lower to the 34,127-point resistance level.

The immediate support level stands at 33,000 points, followed by 32,619 points, which corresponds to the low of May 25th.

On the upside, the immediate resistance is situated at 34,127 points, which was last seen on September 29th, followed by the 35,000-point mark.