Sunway Real Estate Investment Trust’s (Sunway REIT) longer-term prospects remain strong as it aims to grow its asset value to RM14 billion by 2027 (currently RM8.7 billion).

In its Company Update note today (Nov 6), RHB Investment Bank (RHB IB) said Sunway REIT diverse portfolio is expected to drive earnings growth, particularly due to its resilient retail properties and recovering hospitality assets.

This is despite the impact of ongoing asset enhancements on the near-term earnings and the uncertain timeline for the acquisition of six hypermarkets, FY24 should be a strong year as the hypermarkets provide a high 8% NPI yield, and are on a long-term triple-net lease with fixed rental increments.

RHB IB maintains its BUY call, with new RM1.74 TP from MYR1.60, 15% upside and c.7% FY24F yield.

“We increase our FY23-24F earnings estimates by 2% to 5% and introduce our FY25F forecast of MYR373 million. We also cut our ESG

score to 3.2 from 3.4 (our TP now includes a 4% ESG premium) after normalising the scores across our coverage.

Its key risks to call include lower-than-expected occupancy and rental reversion, longer-than-expected delays in acquisitions, and higher-than-expected costs.

The research house said the deadline to complete the acquisition of six hypermarkets for a purchase consideration of MYR520 million has been extended from end-September to end-November, as it is still pending regulatory approvals.

The research house said the group if also focusing on significant asset enhancement initiative or AEIs for retail.

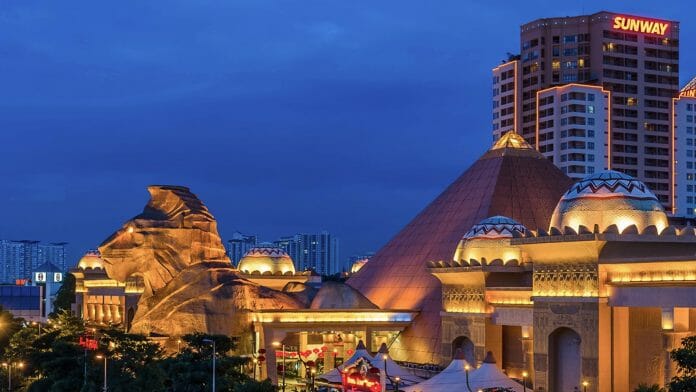

‘This include Such as reconfiguring space in Sunway Pyramid previously occupied by Aeon (11% of NLA, 2% of the mall’s revenue) to welcome Jaya Grocer as new anchor tenant. It is expected to be completed by 4Q24.

‘It is also on the second phase of AEI to refurbish older wing expected to be completed by 2Q25 for Sunway Carnival, which opened a new wing in June last year (NLA rose to c.710k sq ft from c.450k sq ft).

RHB IB also said that in 1H23, the average hotel occupancy was also increased at 60%, up from 48% in 1H22 (FY22: 54%).

“We expect occupancy to gradually recover to the pre-pandemic level of 70%, and for average room rates to remain high – especially for Sunway Resort, following its completed renovation works.

“For offices, the average occupancy is at 83%, dragged by Sunway Tower (27% occupancy). We expect office properties to record low single digit rental reversion, aside from Sunway Tower.