Mah Sing Group Berhad is set to bolster Malaysia’s industrial landscape with the acquisition of 561.65 acres of prime industrial land in Sepang. The development, named Mah Sing Business Park, Sepang, is estimated to have a gross development value (GDV) of up to RM2 billion, marking a significant stride in the country’s industrial growth.

The first phase of the development comprises 185 acres, known as Mah Sing Business Park, which alone is expected to yield an approximate GDV of RM728 million. Fusion Heights Development Sdn Bhd, a subsidiary of Mah Sing South Sea Industrial Development Sdn Bhd, will spearhead the project, with an option to acquire an additional 376.65 acres in the future.

The strategic investment structure involved an initial 10% downpayment, with the remaining 90% payable three months after the completion of conditions precedent. The landowner, Premier Land Resources Sdn Bhd, grants the option for further acquisition within four years of the Sale and Purchase Agreement.

Crucially, the landowner will also become a 20% shareholder in Fusion Heights Development, fostering credibility and confidence in the success of Mah Sing Business Park. This unique investment model mitigates risk, provides growth opportunities, and aligns with Mah Sing’s commitment to sustainable development.

Mah Sing Business Park, Sepang, is envisioned as a world-class industrial hub, encompassing customised factories, industrial lots, cluster, semi-D, and detached factories. The development aims to attract businesses from high-tech manufacturing and value creation sectors, contributing to Malaysia’s industrial prowess.

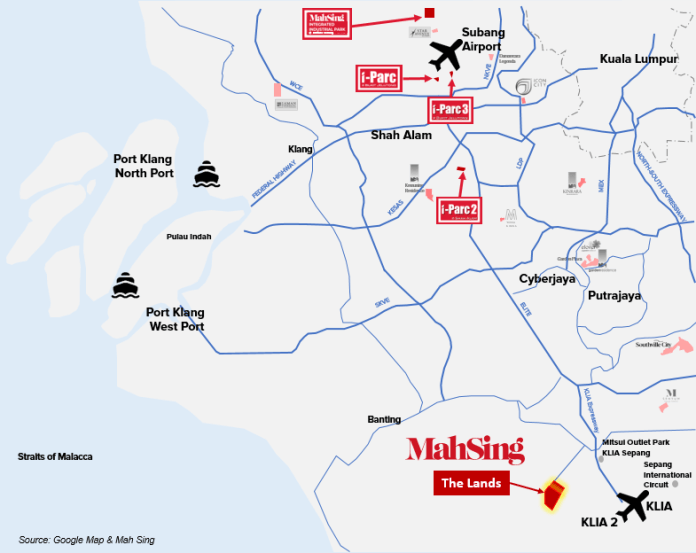

The location boasts excellent connectivity, situated just 10km from Kuala Lumpur International Airport (KLIA). This strategic position facilitates logistics flexibility, cost optimisation, and easy access to international markets. Additionally, the development aligns with the Integrated Development Region in South Selangor (IDRISS), a key initiative under the First Selangor Plan 2021-2025, with an estimated GDV of RM1 trillion.

Mah Sing’s Chairman, Tan Sri Dato’ Sri Leong Hoy Kum, emphasised the strategic timing of the acquisition, aligning with Malaysia’s New Industrial Master Plan (NIMP) 2030. The NIMP focuses on transforming industrial estates into eco-industrial parks, aligning seamlessly with Mah Sing’s commitment to creating sustainable and customized industrial spaces.

The acquisition strengthens Mah Sing’s position in Malaysia’s industrial property market, tapping into the country’s proactive policies to attract foreign direct investment (FDI). With a track record of attracting international investors, Mah Sing’s foray into Sepang presents a prime investment opportunity, especially within Malaysia’s flourishing industrial landscape.

As Malaysia positions itself as a preferred destination for enterprises seeking efficient investments, Mah Sing Business Park, Sepang, emerges as a flagship development contributing to the nation’s industrial growth.

Subject to authorities’ approval, the development is slated to commence in the second half of 2024, spanning a 3 to 4-year timeline. The acquisition increased Mah Sing’s prime landbanks to 2,471 acres, with a total remaining GDV and unbilled sales of RM27.56 billion. The company’s industrial development portfolio continues to grow, underlining its commitment to shaping Malaysia’s industrial future.

Mah Sing anticipated the Mah Sing Business Park, Sepang, to not only contribute to its growth and earnings prospects but also position itself as a leader in providing holistic solutions for investors seeking to establish manufacturing facilities in Malaysia.

The project, guided by innovative strategies and collaboration, is poised to become a cornerstone in Malaysia’s industrial development journey.