Moomoo Malaysia has embarked on its mission to gain a significant share of the nation’s fintech sector, targeting nearly 30% market penetration within less than three years through its innovative trading platform, namely moomoo.

Its chief operating officer Dennis Jee (pic) spoke to BusinessToday exclusively saying that the platform demonstrated its capacity for rapid growth and positive rapid user response in markets such as the US, Singapore, Australia, Japan and Canada.

“At Moomoo, being a global financial technology company, we see this mission as an opportunity for innovation. Our platform reimagines financial education by combining robust tools with an emphasis on learning for investors across the experience spectrum,” Jee said.

Moomoo’s trading platform was launched in Malaysia on Feb 27, having obtained a Capital Market Services license from the Securities Commission allowing engagement in securities and derivatives trading and clearing for securities and derivatives nationwide.

What does the Moomoo platform do, and what services does it offer?

Jee said Moomoo is an all-in-one investment powerhouse. We don’t just offer trades; we provide the tools, the data, and the knowledge you need to make informed investment decisions, no matter your experience level. Our goal is simple: to transform the investing experience for Malaysians.

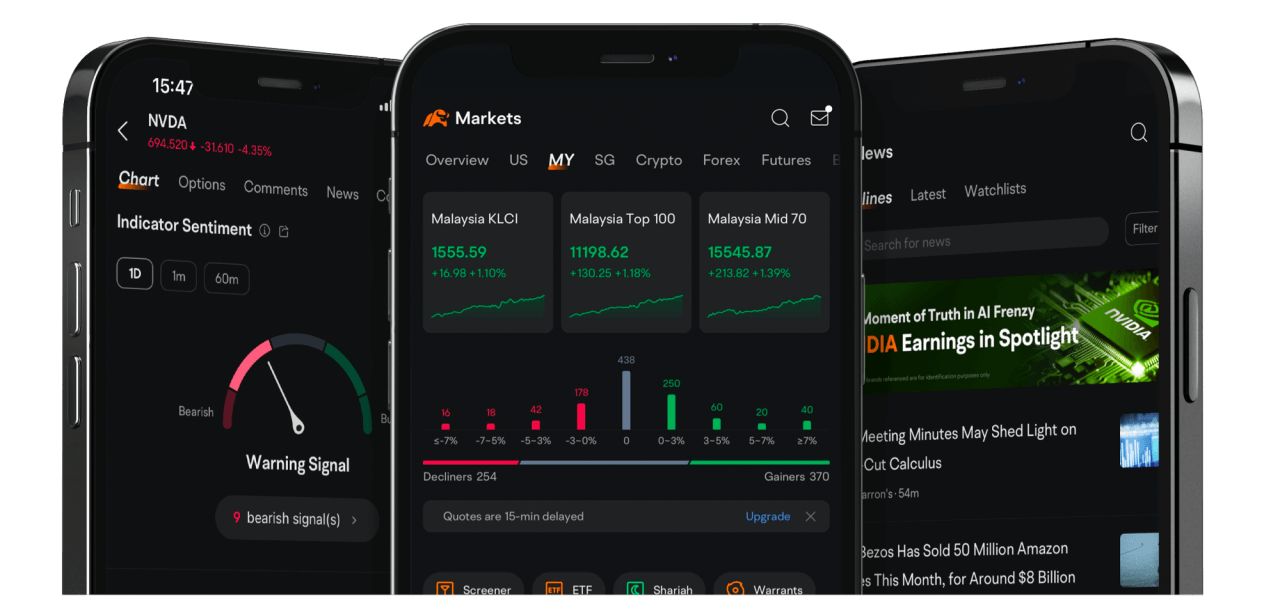

Malaysian users gain access to an extensive array of features, including over 10,000 Malaysia and US stocks, ETFs, and more, alongside AI-driven analytical tools, research resources, advanced charting capabilities, real-time data, and breaking news sourced from over 150 top media agencies—all seamlessly integrated within the Moomoo platform. Additionally, all Moomoo MY brokerage account holders enjoy complimentary access to Level 1 MY stock and Level 2 US stock market depth quotes. For a limited time, we’re also offering zero-commission trading on stocks and ETFs for both Malaysian and US markets.

With Moomoo, there’s no need to scour various pages or pay subscription fees for data — everything you need is conveniently consolidated within our user-friendly platform. We firmly believe that our competitive pricing model, coupled with the wealth of features and educational resources available on our platform, embodies our commitment to empowering investors, both new and seasoned, with unparalleled value and opportunities for financial growth.

What are the notable features of the Moomoo app?

Unlike many other platforms, Moomoo offers a range of unique technological features that enhance the investment experience for its users. For example:

Moomoo Stock Screener – Think of it as a personalized stock search engine. It helps you discover investment opportunities aligned with your goals and preferences, saving you valuable time and effort. It’s a valuable tool for investors to identify potential investments and start building a diversified portfolio. And we built this tool directly into the platform for convenient access and informed decision-making.

Moomoo’s Institutional Tracking is another great feature for new or even seasoned investors. This feature gives you insights into the trading activities of major institutions. This can be valuable information for investors who want to understand where the “big money” is going. You’re tracking companies that specialise in this business, getting an insight into their investing strategies- all right from the comfort of your screen.

Another feature that I think is very valuable is our Industrial Chain – With Industry chain, you can have a big-picture view of a specific industry. For example, imagine exploring the entire electric vehicle (EV) ecosystem, from manufacturers to suppliers and even tech companies. It helps you visualize the interconnectedness of businesses and identify potential investment opportunities across the chain. Take ChatGPT, for example which was one of the most talked about innovation in 2023 and has seen over 50% growth. While companies like Microsoft, Nvidia and Apple are well-known players, our Industrial Chain helps you discover over 90 other companies involved in various aspects like infrastructure, algorithms, and applications. This can help investors explore beyond the obvious choices.

Moomoo users benefit from free access to all these professional-grade resources typically associated with premium services.

The lack of widespread financial literacy poses a fundamental barrier to inclusive and equitable wealth creation. Traditional approaches centered around complex information and intimidating jargon have proved less effective.

For example, new investors require clarity and confidence.

“Our foundational resources break down financial concepts into easily digestible formats, empowering individuals to navigate the financial world without feeling overwhelmed. As investors gain experience, their needs shift towards deeper insights and analysis. Moomoo offers research reports, market analysis tools, and thought-provoking webinars hosted by industry leaders, fostering a continuous learning mindset and informed decision-making. For the most experienced investors, we offer the advanced tools they need to delve deeply into the markets. Real-time data, customisable charting, and a constant news flow ensure they operate with speed and a nuanced understanding of global market trends,” Jee added.

Jee also believes in making investing less ‘lonesome or alone’. Moomoo’s thriving ‘moo community’ breaks down the siloed nature of investing. This collaborative space encourages the exchange of ideas and promotes learning through shared experiences. Beginners benefit from peer guidance, while seasoned investors gain access to new perspectives and potential strategies.

Todate, Moomoo has over 1 000 experts, key opinion leaders and a 21 million strong global investor community as part of our Moo Community. is the best way for investors to share trading ideas and strategies with other like-minded investors and benefit from the experience of others to build their confidence.

Beyond these in-platform features, we actively champion financial education initiatives that extend into the broader community. We’ve done this Hong Kong and Singapore extensively, especially among the youth, in partnerships with industry experts, financial institutions, or even government agencies to drive wider financial literacy programs. Our goal is to cultivate a wider pool of informed investors, ultimately contributing to a more vibrant and resilient financial ecosystem.

Where was the first launch in Southeast Asia?

Moomoo’s Southeast Asian journey began with our landmark launch in Singapore. Our commitment to innovation, education, and exceptional user experience propelled us to quickly become one of the top financial apps in the country. We now proudly serve over a quarter of the young adult population in Singapore.

This resounding success validates our market expansion strategy and bolsters our confidence as we enter new markets across the region.

How does Moomoo differ from other trading platforms in the market?

We view our mission beyond mere profit-making; we aim to contribute significantly to the countries we operate in, the investors we serve, and the broader financial industry as a whole.

From an investor perspective, our commitment to growing alongside our clients sets us apart. We prioritize customer satisfaction and invest extensively in optimising user experience, recognizing it as a cornerstone of our business. We provide not just trading tools, but a comprehensive suite of educational resources, advanced charting capabilities, and a vibrant community. Our goal is to enable investors of all levels to make informed decisions with confidence.

Our proprietary platform prioritises speed, stability, and a seamless user experience. We aggressively invest in innovation to ensure our technology remains a step ahead of the market. We challenge the notion that financial information should come at a premium.

And that’s why we offer a powerful platform with comprehensive pro-level features, real-time market data, breaking news, essential financial information, and educational resources directly from the Moomoo app, for free to our users.

Our strategy encompasses more than transactional efficiency; we’re committed to fostering financial literacy, healthy investment habits and providing an accessible, user-friendly platform.

Beyond that, we also look at how we can make an impact on the wider investment ecosystem. In Malaysia, we perceive three key areas where we can make a substantial impact. Firstly, we recognize the opportunity to elevate the technological capabilities within the brokerage sector. Drawing from our successful experience in Hong Kong, where we set a global standard in brokerage technology, we aim to replicate this achievement in Malaysia. By introducing advanced technological solutions, we not only enhance the competitiveness of Malaysia’s financial market but also establish a precedent for technological innovation in the sector.

Secondly, we are committed to increasing investor participation and financial literacy in Malaysia in support of local regulators and governmental bodies initiatives in this area. We aim to raise awareness about investment opportunities and provide the necessary education to empower investors to make informed decisions. By fostering a culture of investment and financial literacy, we believe we can contribute to economic growth and prosperity in the country.

Thirdly, we aspire to position ourselves as a global trading platform, connecting investors in Malaysia with international markets and assets. Through our user-friendly platform and comprehensive suite of services, we aim to facilitate seamless transactions and provide access to a diverse range of financial products. And in the future, introduce Malaysian financial products to our global base of users, enabling local investment products to reach an international audience and expand its global footprint.

Does Moomoo plan to expand to other ASEAN countries? If so, please elaborate.

The potential in Southeast Asia is evident, especially with its leading GDP growth globally. This growth is not only economic but also driven by demographic changes, notably a younger population, which presents significant opportunities.

The surge in internet and mobile internet usage has led to a shift towards digital services such as ride-hailing and e-commerce, which gain quick acceptance among the general populace. However, there’s a subsequent wave in digital adoption, particularly in stock investment and fintech services, where we see considerable potential.

Southeast Asia, particularly Singapore and Malaysia, is witnessing rapid financial digitalization and fintech adoption, especially among the younger demographic. Brokerages that lag in offering online services risk falling behind as consumer expectations rise in the evolving digital landscape.

As a supplier, Moomoo’s role is pivotal, ensuring a harmonious balance between supply and demand. This aspect is crucial in our global business analysis, guiding decisions on operational licenses allocation, considering our finite resources and strategic global outlook.

What are the projections for Moomoo in Malaysia? Any targets for CY24 compared to CY23?

Malaysia is actively seeking to elevate its brokerage sector’s technological capabilities, positioning itself for greater competitiveness in the global financial market. We’re incredibly excited to enter this market and contribute to this evolution. Our experience in markets like the US, Singapore, Australia, Japan, and Canada – including securing nearly 30% market penetration in Singapore within three years – demonstrates our ability to deliver innovative solutions and rapid growth. We fully intend to replicate this success in Malaysia.

This potential is already evident in the incredible response from Malaysian investors. Building on our global fintech expertise in markets like Singapore and Hong Kong, we aim to set a new chnological benchmark in the Malaysian brokerage sector. Our immediate priority is to establish Moomoo as the preferred choice for Malaysian investors by delivering an exceptional user experience, robust educational resources, and continuous innovation. This user-centric approach fuels our strategies for long-term, sustainable growth and contributes to the overall expansion and sophistication of the Malaysian market.

Our long-term vision is to serve a substantial portion of the Malaysian investing population, and perhaps even exceeding the penetration levels we’ve achieved in markets like Singapore.

How does the Moomoo app perform compared to similar applications in Malaysia?

The app has received a tremendous response since its launch marked by a high number of downloads. So, we are incredibly excited to achieve this significant milestone in the Malaysian market and are deeply grateful for the overwhelming support and enthusiasm we’ve received from investors.

Drawing on our technical expertise and extensive global experience, akin to our achievements in Singapore and Hong Kong, where we established pioneering benchmarks in fintech technology, we aim to set a precedent for the industry, serving as a blueprint for others to emulate.