The banking industry’s loan growth continued to trend upward, expanding by 0.1% pt mom to 5.8% yoy at end-Feb 24.

CGS International (CGS), in its Strategy Note today (Apr 2), said the improvement was seen in both major loan segments – from 6% yoy at end-Jan 24 to 6.1% yoy at end-Feb 24 for household loans and from 4.3% yoy at end-Jan 24 to 4.7% yoy at end-Feb 24 for business loans.

Notably, auto loan growth was robust, according to data from Bank Negara (BNM), with improvement from 10.2% yoy at end-Jan 24 to 10.4% yoy at end-Feb 24.

Not overly concerned about potential pullback in loan growth

CGS believes the industry’s loan growth will moderate (from 5.8% yoy at end-Feb 24) in the next 2-3 months given the weak leading loan indicators in Feb 23. In Feb 23, the industry’s loan applications and approvals declined by 11.3% yoy and 16.8% yoy, respectively, according to BNM.

This is in line with their projection of slower loan growth of 4-5% for 2024F (vs. 5.8% yoy growth at end-Feb 24) as CGS does not expect the strong 10.4% yoy expansion in auto loans at end-Feb 24 to be sustainable (CGS projects lower auto sales in 2024F vs. the level in 2023).

However, CGS thinks growth momentum for business loans will be sustained at 4-5% yoy in 2024F (given their GDP growth forecast of 4.6% in 2024F).

Stable asset quality

Banks’ impaired loan ratios were stable in Jan 24 and Feb 24 (maintained at 1.64% gross and 1.03% net) in BNM’s monthly release of banking statistics. Loan loss coverage declined slightly from 93% at end-Jan 24 to 92.4% at end-Feb 24, which they deem as comfortable (close to 100% coverage).

Reaffirm Overweight on banks

CGS reaffirmed their Overweight call on banks, supported by the sector’s strong dividend yield of 5.2% for CY24F. Furthermore, the sector’s CY25 P/E of 9.4x is attractive relative to its 5-year historical average of 11.8x.

Re-rating catalysts include potential writeback in management overlays and increases in dividend payout ratios.

Potential downside risks are a material deterioration in loan growth and asset quality.

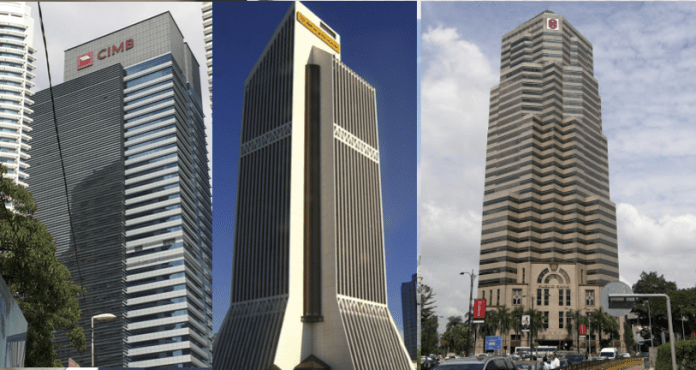

CIMB Group Holdings replaces RHB Bank as one of CGS’s top picks for the sector given its attractive valuation (CY25F P/E of 8.5x vs. sector’s 9.4x) and above-sector loan growth. CGS’s other picks for the sector are HLB (strong asset quality and above-industry loan growth) and Public Bank (potential writeback in management overlay).