While Bank Negara Malaysia’s (BNM’s) revision of the Overnight Policy Rate (OPR) to 2.75%, is primarily a move to maintain economic growth amid a moderate domestic and global outlook, it also serves as a stimulus for the nation’s property market, PropertyGuru Malaysia said in a statement.

“While changes to the OPR have minimal impact upon home loan rates, with a cut of 25 basis points translating to a fractional reduction in loan installments, it is still a silver lining for industry players largely overlooked by Budget 2020,” says Sheldon Fernandez, Country Manager, PropertyGuru Malaysia.

“However, the timing of the revision comes as a surprise, with many analysts having anticipated a steady OPR of 3% through January, with some projections extending this to mid-year. It is, nevertheless, a boon for Malaysian home seekers stricken by housing affordability, availability and financing challenges, as a step towards a more conducive lending environment.”

Potential upswing in consumer sentiment

As the prevailing rate at which banks borrow funds to finance loans, a reduction in the OPR will reduce interest rates applied to consumers for home loans and other financial instruments. This in turn leads to cheaper loans, with a 13% increase in loan approvals reported following a similar OPR cut to 3% in May 2019.

“The new OPR rate of 2.75% may lead to an upswing in purchaser sentiment as home seekers leverage on lower interest rates, with renewed interest in home ownership in the first quarter. As such, it is an opportune time to review the state of property and affordable housing in the market,” says Fernandez.

Bank Negara’s move is set against a backdrop of overpriced properties, prevalent loan rejections and a resulting residential overhang in the property segment, dashing the home ownership aspirations of younger home seekers in the country and placing a national emphasis on affordable housing efforts.

The residential overhang stood at 31,092 units as of Q3 2019 according to the National Property InformationCentre (Napic), representing the number of units remaining unsold nine months after launch, as defined by the Valuation and Property Services Department (JPPH).

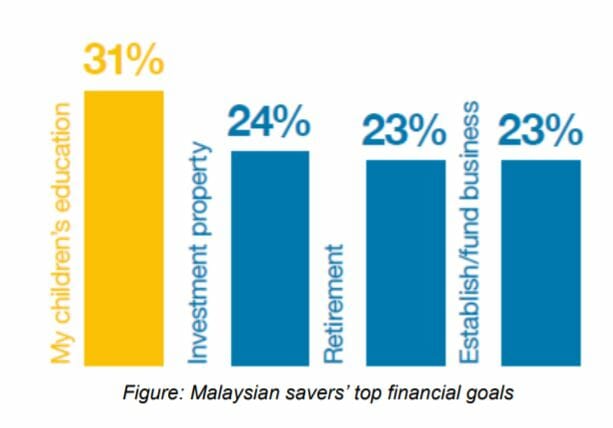

Pricing and affordability concerns are generally cited as factors behind the slow uptake of these units. Despite calls for more affordable housing, many home seekers have not applied for – or may not even be aware of – the numerous housing schemes and financing initiatives designed to help these demographics purchase homes, according to PropertyGuru Malaysia’s most recent Consumer Sentiment Survey.

“By our findings, 63% of Malaysians feel that the government is not doing enough to make housing affordable. However, 30% also share that they have yet to apply for affordable housing schemes, and 3% even reported that they did not know such schemes existed,” says Fernandez.

“This shows that there’s room to improve in terms of awareness of affordable housing schemes in the country. In line with our commitment to being the property adviser of choice for Malaysia, particularly with the potential increase in sentiment following BNM’s OPR cut, we’ve reviewed existing schemes to help B40 and M40 purchasers

in owning their own homes.”

Current housing schemes available include Perumahan Rakyat 1Malaysia (PR1MA), Rumah Selangorku, Residensi Wilayah (formerly RumaWIP), Skim Rumah Pertamaku and Program Perumahan Awam 1 Malaysia (PPA1M). In addition to these, initiatives such as Bank Simpanan Nasional’s Youth Housing Scheme, Bank Negara Malaysia’s

Fund for Affordable Homes and various rent-to-own (RTO) programmes have been launched to assist Malaysians in financing their home purchases.

However, uptake of these programmes leaves room to be desired. According to the PropertyGuru Consumer Sentiment Survey data, only 19% of respondents have applied for purchases under PR1MA. Other schemes fared even worse, with 9% applying to Rumah Selangorku, 7% to Residensi Wilayah, 6% to Skim Rumah Pertamaku and

just 5% to PPA1M.

“Part of the problem is financial eligibility criteria. Each housing scheme may have different requirements, in terms of income as well as other factors. This can lead to confusion among home buyers as to which programmes they qualify for,” says Sheldon.

A question of financing

Some quarters have raised concerns that such housing and financing schemes may have unanticipated repercussions as well, with younger property purchasers committing themselves to lifelong financial commitments they are ill-equipped to handle. This is echoed by independent studies which have found that RTO schemes can

cost more in the long-run than conventional financing platforms.

“While this research needs to be taken into consideration, RTO programmes are still viable solutions for those who struggle with the upfront costs of home ownership,” says Ferndandez.

“In the end, no amount of income is sufficient to service monthly home loan commitments if spending is not managed carefully. This is why we applaud the move BNM has taken for its Fund for Affordable Homes, by making Credit Counselling and Debt Management Agency (AKPK) financial education modules mandatory for those seeking financial assistance.”

The Fund for Affordable Homes is available until January 2021, or until its RM1 billion allocation is fully utilised. This programme has seen positive uptake, receiving over 3,100 applications for funds totalling RM596 million as of November 2019.

For home seekers who opt for conventional home loans, a variety of financial eligibility tools such as PropertyGuru Loan Pre-Approval https://www.propertyguru.com.my/ preapproval) are available for Malaysians to check their pre-approved loan amounts ahead of time, allowing them to avoid the financial black marks associated with home

loan rejections.