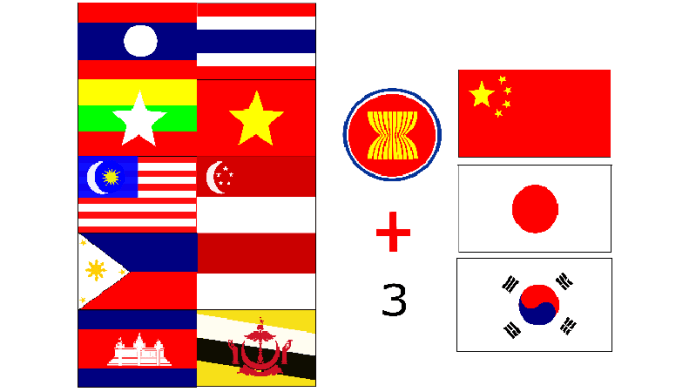

The ASEAN+3 Macroeconomic Research Office (AMRO) has revised downwards its short-term growth forecast for the ASEAN+3 region. The continuing strict dynamic zero-COVID policy and real estate sector weakness in China and potential recessions in the United States and the euro area are weighing on the region’s outlook.

In its October Update, AMRO staff forecasts the ASEAN+3 region to grow by 3.7 percent this year—down from the 4.3 percent growth projected in July reflecting mainly weaker growth in Plus-3 economies. The ASEAN region is expected to grow strongly by 5.3 percent. The region’s inflation rate for 2022 is now projected to be 6.2 percent—a full percentage point higher than previously forecast. Growth is expected to increase to 4.6 percent in 2023 as China’s economy picks up, with inflation moderating to about 3.4 percent.

The prolonged war in Ukraine is deepening Europe’s energy crisis, pushing it closer to recession. In the United States, aggressive monetary tightening to fight persistently high inflation is intensifying fears of a hard landing.

“A simultaneous economic slowdown in the United States and euro area, in conjunction with tightening global financial conditions, would have negative spillover effects for the region through trade and financial channels,” said AMRO Chief Economist, Hoe Ee Khor.

In ASEAN+3, inflation is accelerating. Food and fuel prices remain elevated despite recent easing in key global commodity benchmarks. Subsidy cuts in some economies and depreciating currencies have also pushed prices higher.

“Central banks in the region are raising policy interest rates to safeguard price stability and support their currencies. However, the pace of monetary tightening has generally been more measured and gradual than in the United States and the euro area,” said Dr. Khor.